Are you grappling with the complexities of property taxes in New York City? Navigating the intricacies of property tax assessments, payment schedules, and available resources doesn't have to be a daunting task.

Understanding property taxes in New York City is crucial for all property owners. The city's Department of Finance provides numerous online and in-person resources to assist residents in managing their tax obligations effectively. This comprehensive guide will delve into the various aspects of property taxes in NYC, offering clarity and direction every step of the way. Whether you're a seasoned property owner or a first-time buyer, this article will provide essential information to navigate the system with confidence.

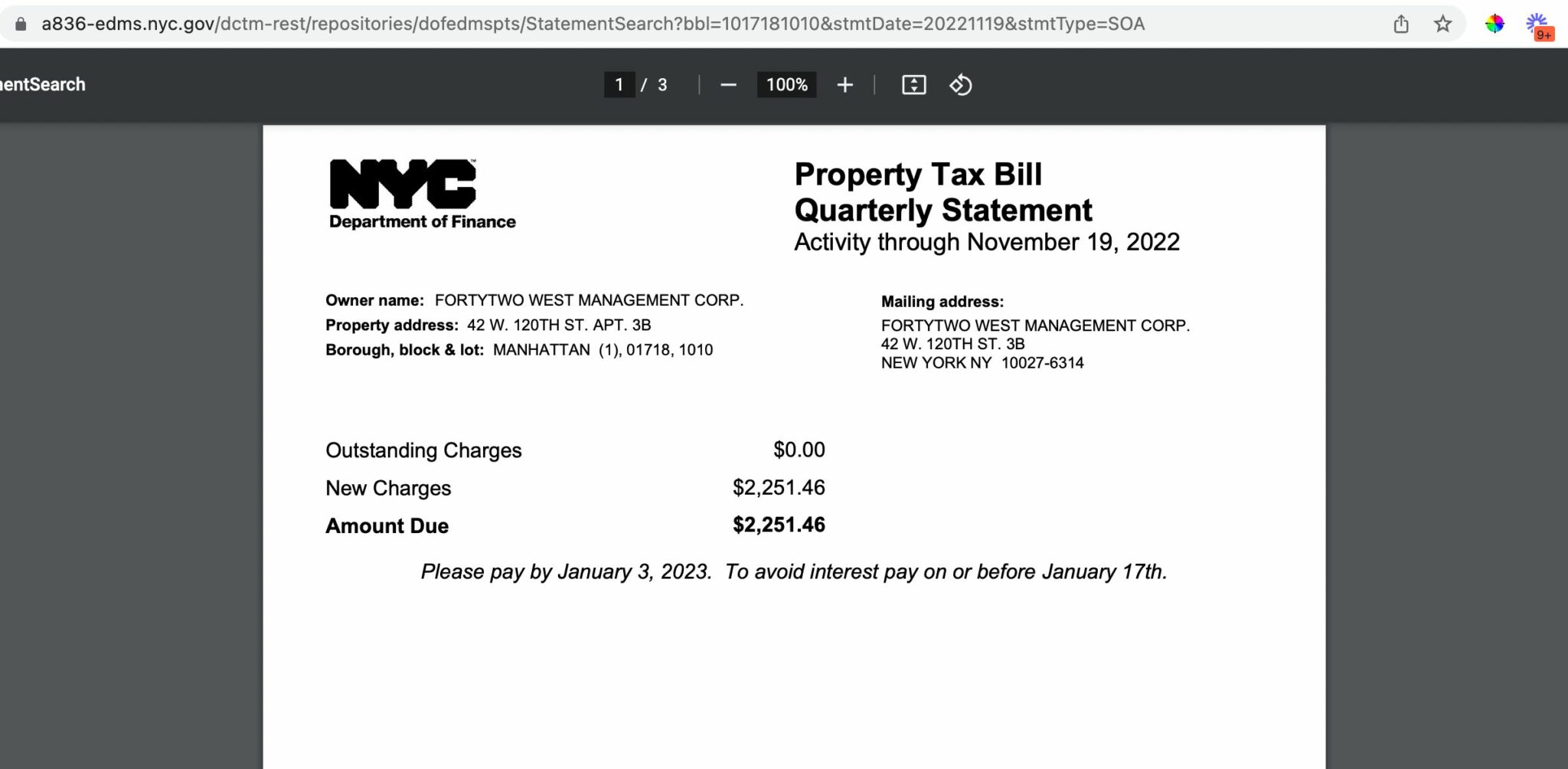

Property tax rates are a fundamental component of the financial landscape for New York City property owners. These rates are determined annually by the New York City Council, typically in November. The established rates directly influence the amount of tax owed, factoring in the property's designated tax class. For the fiscal year spanning July 1, 2024, to June 30, 2025, the City Council has approved new property tax rates. These adjustments will be reflected on the January 2025 property tax bills. It is essential for property owners to stay informed about these rate changes to accurately manage their financial obligations. Staying informed about property tax rates allows property owners to budget accordingly and avoid any financial surprises.

- Explore Blue Basin Oregon Hike Discover John Day Fossil Beds

- Revealed The Tragic Cause Of Heath Ledgers Death

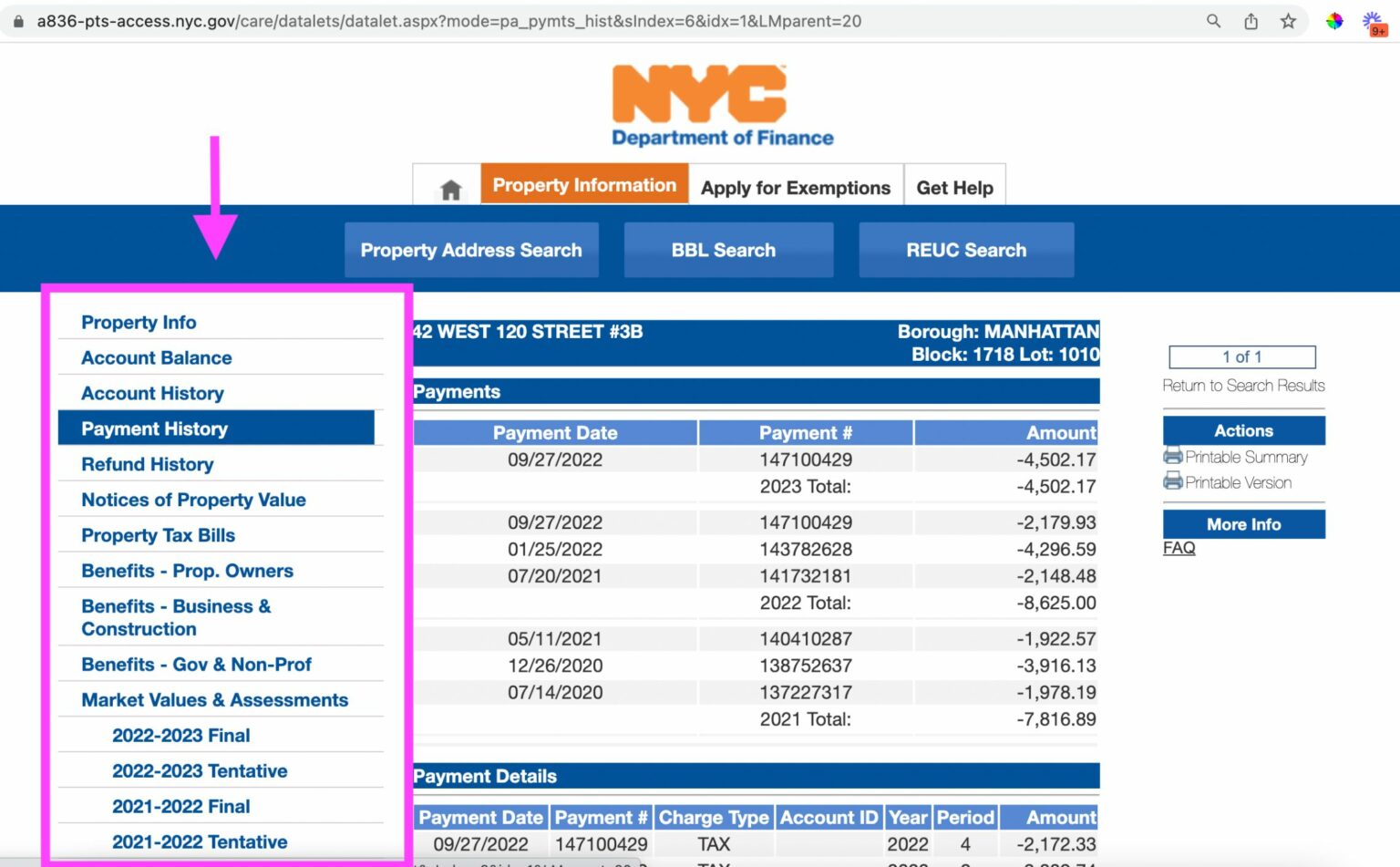

For those looking to streamline their property tax payments, the city offers a convenient option to pay online. This online system, often referred to as CityPay, acts as a comprehensive property information portal, providing users with access to a wide range of services. With a few simple clicks, you can access property records (ACRIS), explore tax exemptions and abatements, and, most importantly, pay your property tax bill. The online system offers ease and efficiency, allowing you to manage your tax obligations from the comfort of your home or office. It also allows you to enroll in monthly property tax bill payments, allowing you to pay your upcoming property taxes in advance. Once you enroll, payments will start on the first day of the following month. However, remember that past due taxes are not included in these automated payments and must be paid separately.

In addition to online payment options, New York City offers alternative methods for settling your property tax bills. You can make in-person payments at City Hall, located on the 1st floor, Room 108, at the cashier's office. For those who prefer to pay online, the city accepts payments via credit card or electronic check, providing flexibility in payment options. The city is committed to providing accessible payment solutions to fit the diverse needs of its residents. It ensures convenience for all property owners by providing multiple payment options.

Furthermore, the City of Yonkers facilitates convenience for its residents by establishing mobile tax payment centers on select dates. For specific details, you can find more information about these centers. The city prioritizes its residents by offering mobile tax payment options for ease and convenience.

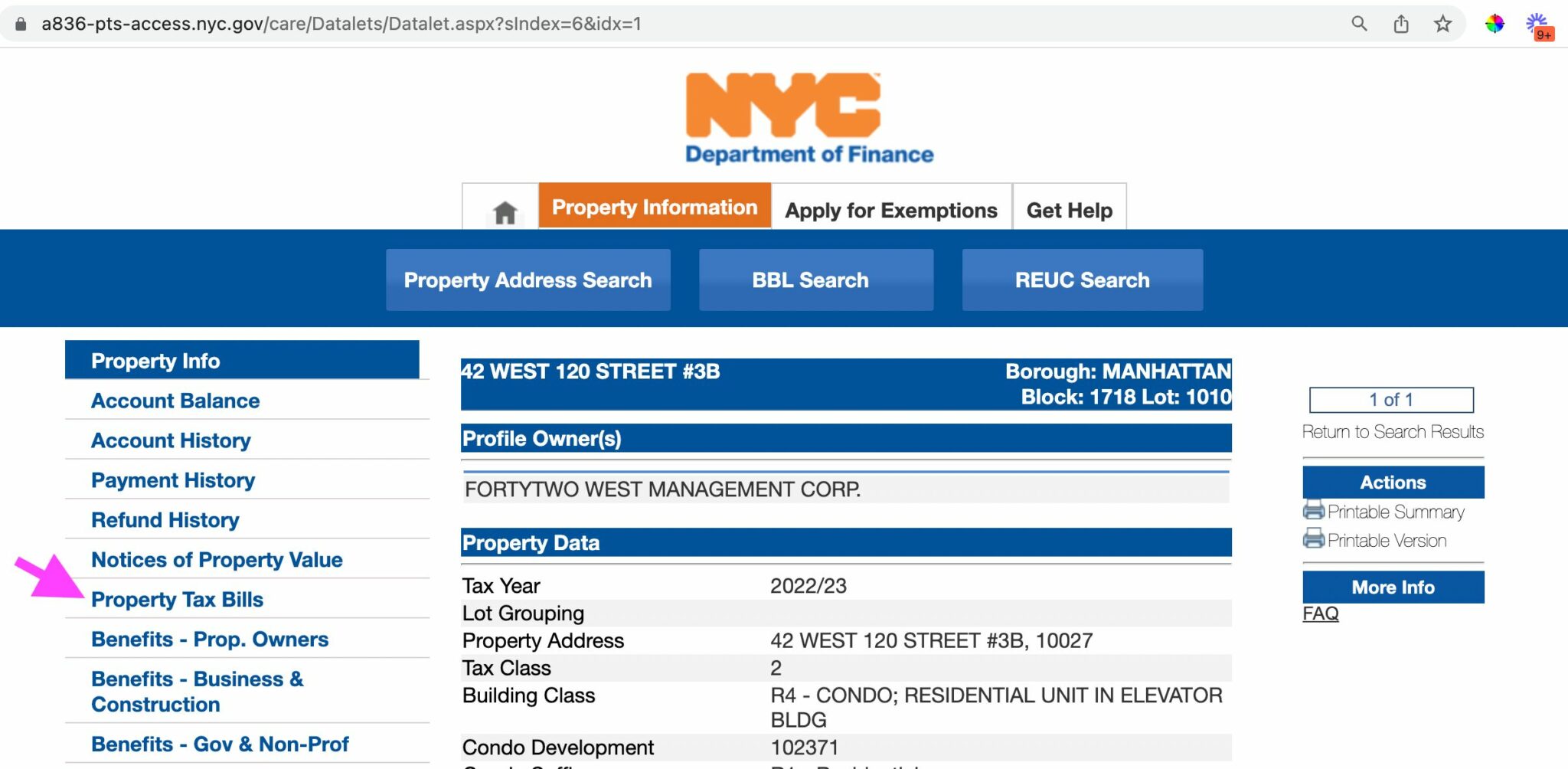

The New York City Department of Finance's property tax public access web portal is a vital resource for all property owners. This portal serves as your central hub for information related to New York City property taxes, offering a wealth of tools and resources. Within this portal, you can look up essential property information, including the property's tax class and market value. This portal is an invaluable resource for every property owner.

If you're looking for a way to estimate your payment amount, the payment agreement estimator can provide assistance. This tool is designed to help you get a realistic picture of your financial obligations. By providing a projected payment amount, you can plan your finances accordingly.

For a streamlined experience, online services provide the quickest and most convenient way to conduct business with the tax department. With an online services account, you can manage your property taxes from anywhere, at any time. You can make payments, respond to department letters, and much more. Setting up an account is simple and easy. It allows you to manage your property taxes seamlessly, ensuring you're always in control of your financial obligations.

| Feature | Details |

|---|---|

| Payment Methods | Online (CityPay), in person at City Hall (1st floor, Room 108), credit card, electronic check |

| Tax Year | July 1 to June 30 |

| Online Services | Pay bills, explore property records, apply for exemptions, respond to department letters |

| Payment Plans | Monthly or quarterly options available, for up to 10 years |

| Helpful Resources | Property tax payment plan information, payment agreement estimator |

| Property Information | Look up tax class, market value, and other property details via the public access portal. |

| Parking Tickets | Check for payment options. |

The city is dedicated to ensuring that residents have access to a variety of resources. The Department of Finance also addresses specific needs, such as sidewalk repair payment plans. If you need to pay for sidewalk repairs arranged by the Department of Transportation, you can request an agreement to pay in installments. This option offers financial relief to property owners.

The city extends its services to encompass various payment needs, and the Department of Finance goes the extra mile to address additional financial commitments. If you have a water and sewer bill payment to handle, the online payment portal provides a solution. This feature consolidates various payment processes in a single, user-friendly interface. By integrating these payment options, you can easily manage your property-related finances.

The city's commitment to providing helpful resources extends to those who have questions about payment plans. For detailed information about payment plans, you can visit the dedicated section of the property tax payment plan. This resource provides comprehensive details, ensuring you have a thorough understanding of available options. These options can help in the efficient management of your finances.

Regarding property tax payment plans, it's essential to understand the conditions involved. When you set up a plan, you will be responsible for both your current property taxes and your scheduled payments as per the plan. Please remember that property taxes continue to accrue interest. Therefore, it's crucial to stay current with your obligations to avoid additional charges.

For a period beginning July 1, 2024, and extending through June 30, 2025, there are specific provisions concerning reduced interest and payment assistance plans. Properties with an assessed value of $250,000 or less might be eligible for special consideration, offering some financial relief. Always consult official sources to ascertain your eligibility and the specific terms applicable to your situation.

The city offers resources for additional support beyond tax-related issues. The Department for the Aging addresses violations to SADC providers that violate New York City Local Law 9 and New York State Office for the Aging Social Adult Day Services Standards. This ensures that service providers comply with the law and provide quality care. Note that all registration submissions and violation payments related to these services must be completed online. This streamlines the compliance process, making it easier for service providers to meet their obligations.

New York City's commitment extends beyond tax-related issues, as it provides avenues for addressing other concerns. If you believe you've been a victim of an internet crime, you can report the incident by filing an online internet crime complaint. You can visit the Internet Crime Complaint Center (IC3) at www.ic3.gov. This service helps to protect residents by providing a platform for reporting cybercrimes.

The city provides various services and information, and you can trust the official nature of the online resources offered through ny.gov websites. These sites are developed to offer reliable resources for residents. The city strives to offer dependable online services.

To search efficiently, remember to fill in the necessary fields to access relevant information. Whether you're looking for information about a property or making a payment, providing accurate information is crucial. Be sure to enter your BBL (borough block lot) number when prompted. This number is a unique identifier for your property.

In the event that you encounter any search difficulties, the site provides support. If search results are not immediately found, the site will guide you to correct your spelling or rephrase your query, ensuring that you can always access the needed information. The goal is to deliver the right information.

The city's official communication channels include online services. While these services are available at all times, there may be occasional maintenance periods. The city strives to keep its services running smoothly while also ensuring that necessary updates and improvements are made. During these brief maintenance periods, you may experience temporary unavailability. These are essential for maintaining top performance.

- Melissa Young From Miss Wisconsin To A Battle With Illness Latest

- Did Walz Law Allow Child Removal For Trans Care Fact Check